What is a Bitcoin Crash?

The term "Bitcoin crash" often evokes images of dramatic headlines and rapidly falling prices. As a volatile asset, Bitcoin has experienced several significant downturns throughout its history, where its value has dropped sharply in a short period. For anyone involved in the crypto market, understanding the dynamics behind these crashes is essential.

This guide explores the primary factors that can trigger a Bitcoin crash, the historical context of past market cycles, and strategies for navigating this inherent volatility.

What Defines a Bitcoin Crash?

While there's no official definition, a Bitcoin crash is generally characterized by a rapid, steep decline in its price, often exceeding 20-30% in a matter of days or weeks. This is typically followed by a prolonged bear market, or "crypto winter," where prices remain low for an extended period before a new cycle of growth begins.

It's important to distinguish a crash from a "correction," which is a shorter-term price drop of 10-20% that often occurs during a broader bull market.

Top 5 Factors That Can Cause a Bitcoin Crash

A Bitcoin crash is rarely caused by a single event. It's usually a combination of factors that create a perfect storm of selling pressure, fear, and uncertainty in the market.

1. Macroeconomic Pressures

Bitcoin no longer exists in a vacuum. It is increasingly integrated into the global financial system, making it sensitive to broad economic trends. Factors that can trigger a sell-off include:

- Rising Interest Rates: When central banks raise interest rates, safer, interest-bearing investments like bonds become more attractive, leading some investors to sell riskier assets like Bitcoin.

- Recession Fears: During times of economic uncertainty, investors tend to move away from speculative assets and into cash or "safe-haven" assets.

- Inflation Data: Unexpectedly high inflation can lead to aggressive monetary policy from central banks, which can negatively impact markets.

2. Regulatory Crackdowns

Unfavorable government actions are one of the most potent catalysts for a crash. News of a major economy banning crypto trading, imposing harsh taxes, or launching a major investigation into a large crypto company can spook investors and lead to widespread panic selling. China's 2021 ban on crypto mining and trading is a prime example of a regulatory event that contributed to a major market downturn.

3. Market Speculation and Over-Leverage

In a bull market, excitement and "fear of missing out" (FOMO) can lead to a speculative bubble. When prices rise too quickly, driven by hype rather than fundamental value, the market becomes unstable.

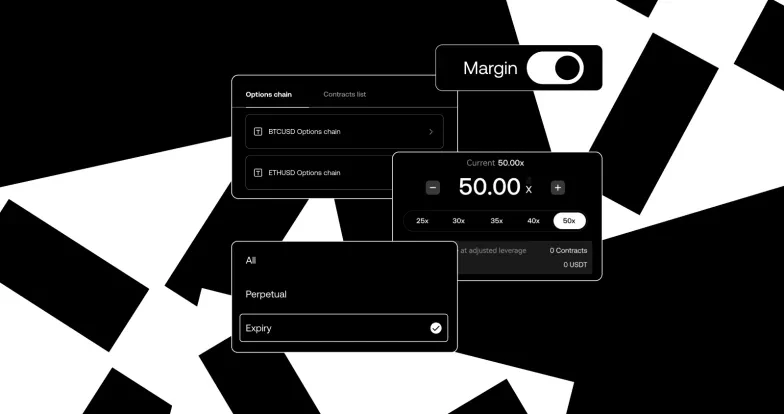

- Leverage: Many traders use borrowed funds (leverage) to amplify their potential gains. However, this also amplifies losses. During a price drop, over-leveraged positions are forced to liquidate, creating a cascade of selling pressure that can cause the price to plummet dramatically.

4. Security Breaches and Scams

The crypto industry is still maturing, and major security failures can severely damage investor confidence. The collapse of a large exchange (like FTX) or the hack of a major DeFi protocol can have a ripple effect across the entire market, triggering a "flight to safety" as investors pull their funds from the ecosystem.

5. Shifts in Market Narrative

The story that investors tell themselves about Bitcoin matters. A shift in the prevailing narrative can impact demand. For example, if a major flaw were discovered in Bitcoin's code, or if a new technology emerged that was perceived as a superior alternative, it could cause investors to question Bitcoin's long-term value proposition.

A Brief History of Major Bitcoin Crashes

Bitcoin's history is marked by a cyclical pattern of massive bull runs followed by deep bear markets.

- 2013-2015: After a huge run-up, the price crashed following the collapse of the Mt. Gox exchange, which handled the majority of Bitcoin transactions at the time. The ensuing bear market lasted for over a year.

- 2017-2018: The massive bull run of 2017, which saw Bitcoin reach nearly $20,000, was followed by an equally dramatic crash in 2018. The market was characterized by an ICO (Initial Coin Offering) bubble and intense retail speculation.

- 2021-2022: After hitting an all-time high of over $68,000, Bitcoin entered a prolonged bear market, driven by a combination of macroeconomic headwinds, the collapse of major crypto firms like Terra/Luna and FTX, and regulatory uncertainty.

Each of these cycles, while painful, has also been followed by a period of recovery and a new all-time high, demonstrating the resilience of the network.

How to Navigate a Bitcoin Crash

For long-term believers in the technology, a crash can be seen as an opportunity. However, it requires a strong stomach and a clear strategy.

- Have a Long-Term Perspective: Understand that volatility is a natural part of the crypto market cycle.

- Dollar-Cost Averaging (DCA): Investing a fixed amount of money at regular intervals, regardless of the price, can help smooth out the impact of volatility.

- Diversify Your Portfolio: Avoid putting all your funds into a single asset.

- Manage Risk: Never invest more than you are willing to lose. Avoid using excessive leverage, especially if you are a beginner.

⚠️ Disclaimer: This content is for informational purposes only and does not constitute financial advice. Cryptocurrencies are highly volatile assets. Past performance is not indicative of future results. Always do your own research.

Frequently Asked Questions (FAQ)

Q1: Could Bitcoin's price go to zero? While theoretically possible, it is considered extremely unlikely by most market observers. For Bitcoin's price to go to zero, the entire global network of miners and nodes would have to shut down permanently, and all confidence in the asset would have to be lost. Given its robust, decentralized nature and growing adoption, this is a highly improbable scenario.

Q2: How is a Bitcoin crash different from a stock market crash? Both are driven by fear and selling pressure, but Bitcoin's volatility is typically more extreme. Because the crypto market is smaller and less liquid than the stock market, price swings can be much larger. It is also a 24/7 global market, meaning crashes can happen at any time.

Q3: Does a crash mean that Bitcoin has failed? No. Historically, crashes have been a recurring feature of Bitcoin's market cycles. They are often a function of washing out excess speculation and leverage from the system, which can lay the groundwork for the next phase of sustainable growth.

Conclusion

A Bitcoin crash can be a daunting experience, but it is a known feature of this emerging asset class. These events are typically driven by a confluence of macroeconomic pressures, regulatory actions, and internal market dynamics like over-leverage and speculation.

By understanding the factors that contribute to these downturns and adopting a disciplined, long-term approach, you can be better prepared to navigate the inherent volatility of the crypto market. Using a secure and regulated platform like OKX can provide the tools and resources needed to manage your digital assets responsibly through all market conditions.