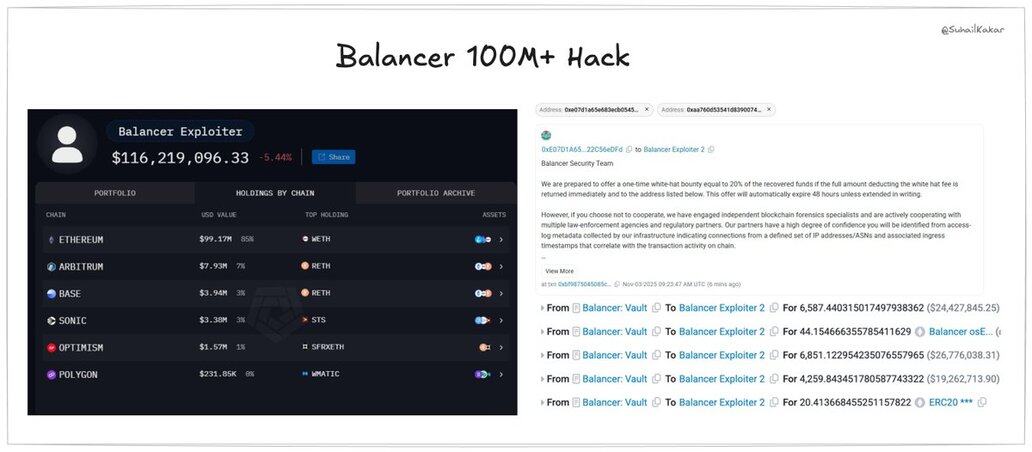

balancer just got drained for ~$116M

this wasn't sophisticated. it was a basic access control bug in their vault contract

here’s how it happened, what it reveals - and why it should scare every defi protocol alive:

1/

the exploit hit balancer v2 today across ethereum, arbitrum, polygon, base, optimism, and more

over $116M gone. 6,590 WETH. 6,851 osETH. 4,260 wstETH

all pulled from the core vault at 0xBA1...BF2C8

2/

the bug was in "manageUserBalance" - a function that's supposed to validate who can move funds

instead, it confused msg.sender with a user-supplied op.sender field

attackers used WITHDRAW_INTERNAL operations to drain tokens they never deposited

3/

what makes this worse?

balancer V2 uses a single vault for everything. every pool, every chain.

hit the vault, hit them all.

many forks are at risk as well.

4/

this is balancer's third major hack in five years

2021, 2023, and now 2025: $116M+ and counting

5/

let's zoom out.

balancer isn't some experiment. $750M TVL. audited.

live for years.and yet: a basic access control flaw sat in prod, audits missed it, no proper sender validation, funds mixed in one central vault.

6/

this is balancer's third major hack in five years

2021: millions lost

2023: $238K after being warned

2025: $116M+

this isn't just a Balancer problem. it's a defi illusion problem

"audited" =/= safe. "battle-tested" =/= secure

7/

takeaway:

basic access control bugs are still destroying blue-chip protocols

if you're building: review every permission check twice.

if you're a user: "audited" means someone looked once, not that it's bulletproof

this wasn't advanced. we're just careless

8/

defi can do better. but first, we need to admit: the basics still matter more than the hype.

i’ll post more as the onchain trail evolves

9/

there are a few reports that the attacker didn't just exploit permissions. they manipulated BPT pricing through precision loss in the StableSwap math.

- drain one token to a rounding edge

- exploit rounding errors to deflate BPT price

- buy back BPT cheap, profit

/10

more details here about how price manipulation was done[1]

still waiting for the balancer’s official response. will keep updating the thread as things unfold.

[1]

12.38 k

80

El contenido al que estás accediendo se ofrece por terceros. A menos que se indique lo contrario, OKX no es autor de la información y no reclama ningún derecho de autor sobre los materiales. El contenido solo se proporciona con fines informativos y no representa las opiniones de OKX. No pretende ser un respaldo de ningún tipo y no debe ser considerado como un consejo de inversión o una solicitud para comprar o vender activos digitales. En la medida en que la IA generativa se utiliza para proporcionar resúmenes u otra información, dicho contenido generado por IA puede ser inexacto o incoherente. Lee el artículo enlazado para más detalles e información. OKX no es responsable del contenido alojado en sitios de terceros. Los holdings de activos digitales, incluidos stablecoins y NFT, suponen un alto nivel de riesgo y pueden fluctuar mucho. Debes considerar cuidadosamente si el trading o holding de activos digitales es adecuado para ti según tu situación financiera.