Tidy-Liveness-Aspen

Tidy-Liveness-Aspen

19Following

105Followers

500U starts over from the beginning, strictly controls emotions (2%-5% principal stop loss), short-term is the mainstay, medium and long-term supplements, do not look at any technical indicators, feel the market sentiment and logic, open an order at any time, when the order is not opened, it means that the entry point in the heart has not been reached, after entering the market, the trend will not meet the expected trend will be withdrawn immediately, do not carry the order to gamble, that is not the money I should make, every time I carry the order is a fluke, the market is unpredictable, once the judgment is wrong is a sharp retracement (at least 30%-40%, at most it is liquidated), it is more important to survive and wait for the bull market, The most important thing in speculation is not to win, but to stay at the table. There will be more short positions in a bad market or uncertainty, because if you enter the market with an unclear direction, it is easy to wear out the principal back and forth (I hope everyone makes money together).

I have stepped on the top of the mountain and entered the trough, both of which have benefited me a lot, and although the climb is long, the scenery at the top is worth it.

Show original

Overview

Futures trades

Spot trades

Bot trades

Stats

Total PnL%+20.11%

Total PnL+$138.94

Assets$829.76

Days active6

Max drawdown-71.40%

Win rate

39.13%Profit/loss ratio

2.60:1Net transfer$683.77

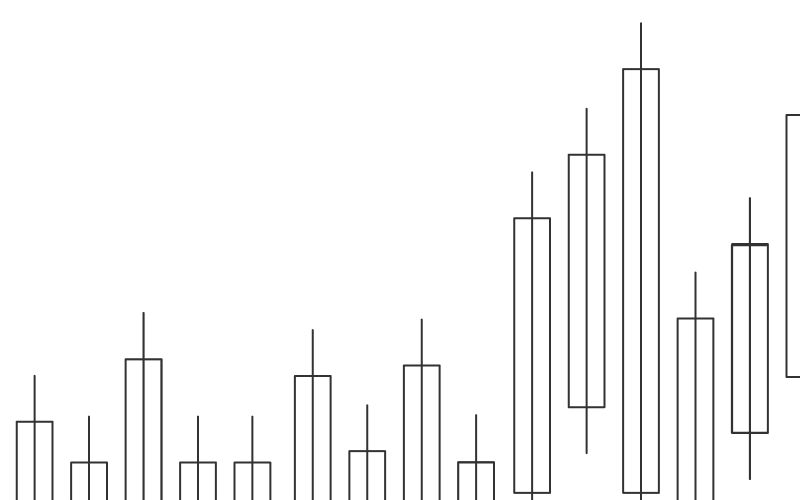

PnL%

PnL

Assets

--

Positions (0)

Assets

Latest records

Open positions

History

Open positions